Are you ready to take control of your taxes and simplify the process? Look no further than the “Ultimate Guide to IRS 2024 W4 Form PDF: Streamline Your Taxes with Efficiency and Confidence.” This comprehensive guide will provide you with all the necessary information and step-by-step instructions to navigate the IRS 2024 W4 form. Whether you’re an individual taxpayer or a business owner, this guide will help you streamline your tax filing process, ensuring efficiency and confidence every step of the way. Say goodbye to confusion and hello to a stress-free tax season!

Related Post:

- Ultimate Guide to IRS 2024 W4 Form PDF: Streamline Your Taxes with Efficiency and Confidence”

- Supercharge Your Tax Filing with Form W-4 2024 PDF: Unleash Savings and Streamline Your Finances!”

- Maximize Your Refunds with 2024 Tax Forms Printable: Simplify and Save!”

- Maximize Your Refunds with W4 Calculator 2024: Boost Your Tax Savings Now!”

- 2024 IRS Tax Forms Printable: Simplify Your Filing Process with Convenient Downloads”

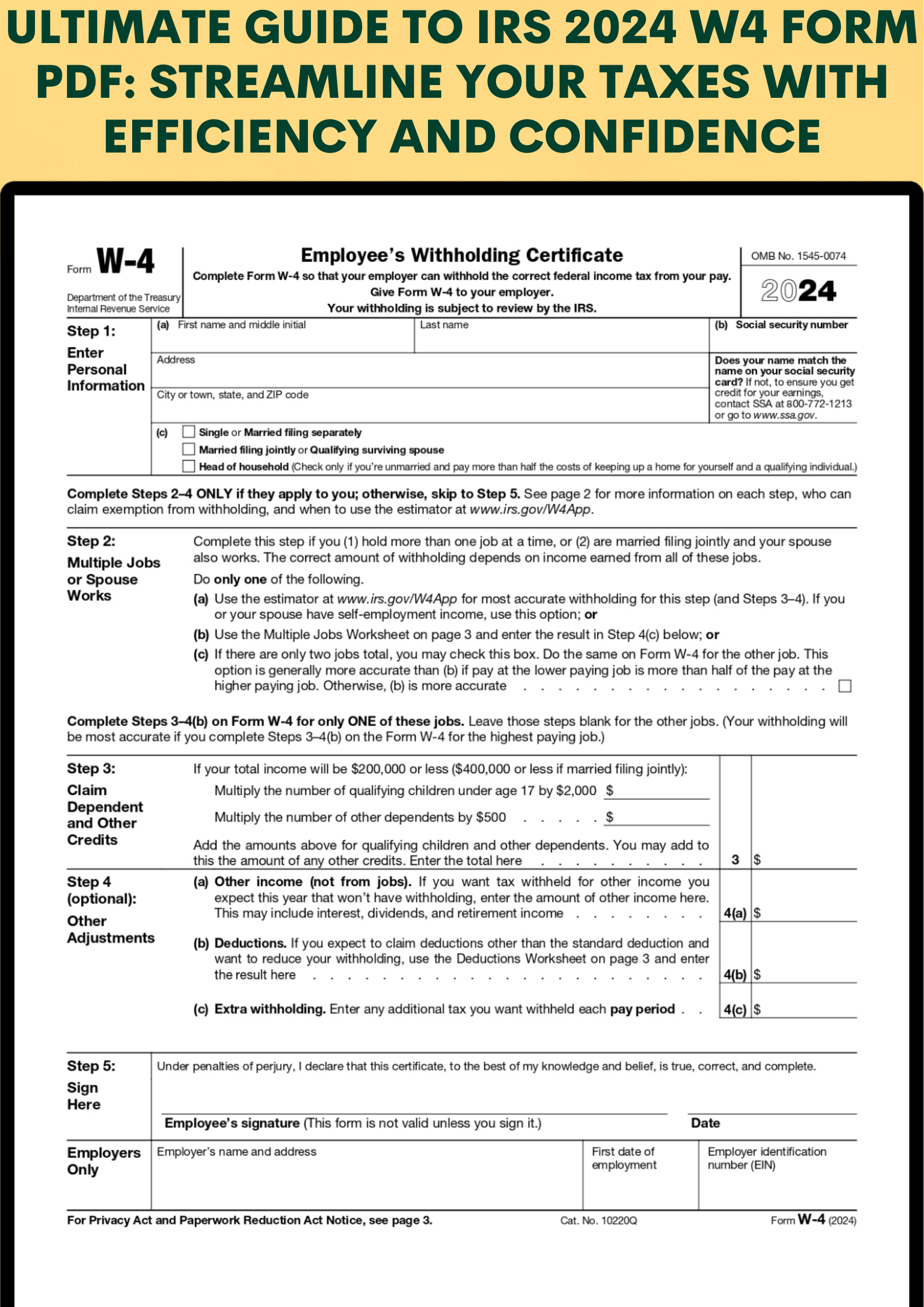

The IRS 2024 W4 Form PDF is an essential document for individuals and employers in the United States. Understanding how to fill out this form correctly can streamline your tax process and ensure you meet your tax obligations efficiently and confidently. In this ultimate guide, we will walk you through the key details of the IRS 2024 W4 Form PDF, providing you with all the information you need to navigate this important document.

What is the IRS 2024 W4 Form PDF?

The IRS 2024 W4 Form PDF, also known as the Employee’s Withholding Certificate, is a document used by employees to inform their employer how much federal income tax should be withheld from their paychecks. The form helps employers calculate the appropriate amount of tax to withhold based on an employee’s filing status, number of dependents, and additional income. Filling out the W4 form accurately is crucial to avoiding over or underpayment of taxes.

Understanding the IRS 2024 W4 Form PDF

The IRS 2024 W4 Form PDF consists of multiple sections that require specific information. Let’s explore each section in detail:

Employee Information

The first section of the IRS 2024 W4 Form PDF requires you to provide your personal details, including your full name, address, Social Security number, and filing status. It is important to ensure that this information is accurate and up-to-date to avoid any discrepancies in your tax records.

Multiple Jobs or Spouse Works

If you have multiple jobs or your spouse also works, this section helps you determine the correct amount of tax to be withheld. It provides two options: the higher-earning spouse can request to have all the additional income withheld, or you can use the IRS withholding estimator for a more accurate calculation.

Dependents

The number of dependents you claim on your IRS 2024 W4 Form PDF affects the amount of tax withheld. By claiming dependents, you can reduce the amount of tax withheld from your paycheck. However, it is crucial to accurately determine the number of dependents you can claim based on IRS guidelines to avoid any penalties or audits.

Other Adjustments

This section allows you to make additional adjustments to your tax withholding. If you have other income sources, deductions, or tax credits, you can use this section to ensure the correct amount of tax is withheld from your paycheck.

How to Fill Out the IRS 2024 W4 Form PDF

Now that you understand the various sections of the IRS 2024 W4 Form PDF, let’s walk through the steps to fill it out accurately:

- Download the IRS 2024 W4 Form PDF from the official IRS website or obtain a physical copy from your employer.

- Provide your personal information in the Employee Information section, ensuring accuracy and completeness.

- Determine if you have multiple jobs or if your spouse works, and select the appropriate option in the corresponding section.

- Enter the number of dependents you can claim based on IRS guidelines.

- Review the Other Adjustments section and make any necessary modifications based on your specific situation.

- Sign and date the form to certify the accuracy of the information provided.

- Submit the completed form to your employer, either electronically or in person.

By following these steps and accurately filling out the IRS 2024 W4 Form PDF, you can ensure that the correct amount of tax is withheld from your paycheck, avoiding any surprises when it comes time to file your tax return.

Conclusion

The IRS 2024 W4 Form PDF is a critical document that determines how much federal income tax is withheld from your paycheck. By understanding the sections of the form and carefully completing it, you can streamline your tax process and feel confident that you are meeting your tax obligations accurately.

Ensure you have the most up-to-date version of the IRS 2024 W4 Form PDF and refer to the instructions provided by the IRS to ensure compliance with the latest guidelines. Use this ultimate guide to navigate the W4 form with efficiency and confidence, maximizing your financial stability and minimizing the risk of penalties or audits.

Here are W4 Form 2024: